Managing taxes in QuickBooks Online can feel overwhelming for many business owners, but the right guidance transforms it into a seamless process. Knowing how to set up and use tax in QuickBooks Online ensures your financial records are accurate, compliant, and ready for reporting. Whether you are just starting your business or upgrading from QuickBooks Desktop, understanding the nuances of online tax setup saves time, reduces errors, and keeps your accounting smooth.

Master QuickBooks Online tax setup with expert tips. Call +1-866-500-0076 for help and accurate accounting guidance.

Why Proper Tax Setup in QuickBooks Online Matters

Incorrect tax setup can lead to penalties, reporting errors, and unnecessary stress during tax season. QuickBooks Online provides built-in tools to manage taxes efficiently. Here’s why you should pay close attention to your tax setup:

Accurate Sales Tax Calculation: Ensures the correct tax rate is applied to each transaction.

Automated Reporting: Generates reports that save hours during tax filing.

Compliance Assurance: Helps businesses meet local, state, and federal tax requirements.

Streamlined Invoicing: Automatically adds taxes to invoices without manual input.

Setting up taxes correctly from the beginning prevents errors that could complicate accounting or require costly corrections.

Step 1: Enable Sales Tax in QuickBooks Online

Before applying tax to your transactions, you need to enable the sales tax feature:

Go to Settings (gear icon) → Taxes → Sales Tax.

Click Set up sales tax.

Enter your business location and tax registration details.

Confirm the settings and save.

Once enabled, QuickBooks Online can calculate taxes automatically on invoices and sales receipts. If any complications arise, support is available at +1-866-500-0076 for personalized assistance.

Step 2: Add Tax Agencies

After enabling sales tax, you must identify the agencies to which you remit taxes:

Navigate to Taxes → Sales Tax → Add Tax.

Enter the agency name, contact information, and tax rates.

Specify filing frequency (monthly, quarterly, or annually).

Save the details to ensure accurate tax tracking.

This step is critical for compliance. Failing to correctly assign tax agencies may result in misreported payments or penalties.

Step 3: Set Up Tax Categories and Rates

QuickBooks Online allows you to assign tax rates to products and services. Here’s how:

Go to Taxes → Sales Tax → Tax Rates and Agencies.

Click Add Tax Rate.

Enter the tax name, rate, and applicable jurisdiction.

Save changes.

You can create multiple rates for different regions, ensuring your invoices reflect the correct tax amount. Businesses operating across state lines should pay extra attention to rates.

Step 4: Apply Tax to Products and Services

Once your rates are set, associate them with products or services:

Go to Sales → Products and Services.

Select the item to edit.

Under Sales Tax, choose the appropriate tax rate.

Save the changes.

This step automates tax calculations in invoices, reducing the risk of human error. If you’re unsure about which tax applies to a product or service, call +1-866-500-0076 to consult with a certified QuickBooks Online expert.

Step 5: Track and Manage Tax Payments

QuickBooks Online generates reports to track tax liability and due dates:

Sales Tax Liability Report: Shows taxes collected and owed.

Tax Payment History: Confirms previously remitted taxes.

Custom Reports: Tailored reports help with audits or internal review.

Paying taxes on time is crucial. QuickBooks Online can remind you of upcoming payments, or you can manually generate reminders. Staying proactive prevents late fees and keeps your books accurate.

Tips for Error-Free Tax Management

To ensure smooth tax management, consider these expert tips:

Regularly Review Tax Rates: Tax laws change frequently. Ensure QuickBooks Online reflects current rates.

Automate Where Possible: Use recurring invoices and automated tax calculations to reduce manual errors.

Separate Taxable and Non-Taxable Items: This ensures only eligible items are taxed.

Consult Professionals: For complex tax situations, experts can help. Call +1-866-500-0076 for professional assistance.

Following these tips saves time, reduces stress, and ensures compliance with state and federal tax laws.

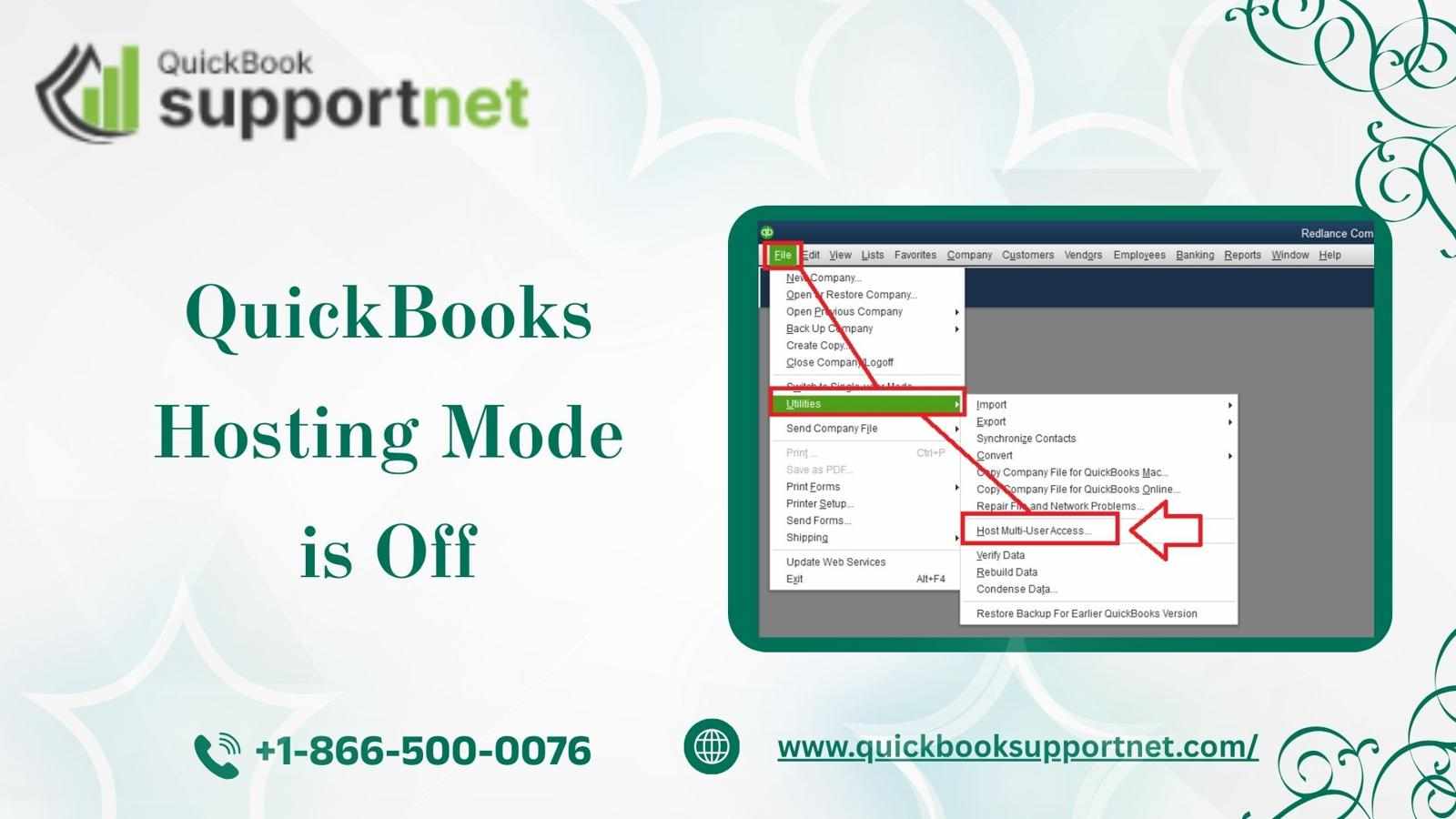

Integration with Other QuickBooks Services

Many businesses benefit from integrating QuickBooks Online tax setup with other QuickBooks services. For instance, combining online tax management with QuickBooks Desktop Cloud Hosting allows businesses to access desktop features remotely, streamline accounting, and maintain consistent records across platforms. This combination provides flexibility and enhances productivity, especially for teams working in multiple locations.

Troubleshooting Common Tax Issues

Even with proper setup, errors can occur. Here’s how to troubleshoot common issues:

Incorrect Tax on Invoice: Check if the product or service has the correct tax rate assigned.

Missing Sales Tax: Verify that the sales tax feature is enabled and the agency is properly configured.

Duplicate Taxes: Ensure you haven’t assigned multiple rates to the same item.

Discrepancies in Reports: Reconcile accounts regularly to catch inconsistencies early.

For persistent issues, expert help is available at +1-866-500-0076 to resolve problems quickly and accurately.

Benefits of Using QuickBooks Online for Taxes

Setting up and using tax in QuickBooks Online comes with numerous benefits:

Accuracy: Automated calculations reduce manual mistakes.

Efficiency: Less time spent calculating and tracking taxes.

Compliance: Ensures adherence to local and federal tax regulations.

Scalability: Supports multiple locations, products, and tax rates.

Integration: Works seamlessly with accounting, payroll, and inventory features.

Investing time in proper tax setup pays off throughout the year, saving both money and stress.

Conclusion

Mastering the process to set up and use tax in QuickBooks Online is essential for any business looking to maintain accurate records, streamline accounting, and stay compliant. From enabling sales tax and assigning agencies to automating calculations and monitoring payments, QuickBooks Online provides a robust solution for businesses of all sizes. If you need hands-on assistance, call +1-866-500-0076 today.

Read Also: QuickBooks Help Near Me: Trusted Local Experts You Can Rely On

Write a comment ...